Beijing Cooldown?

After Games, Trends Point to Property Growth

By J.R. WU

BEIJING -- The run-up to this summer's Olympics ignited an explosion of new commercial and residential space in the Beijing market over the past two years.

The Chinese capital has given itself an urban facelift that includes skyscrapers and sports stadiums, a new third terminal in Beijing's international airport, bigger park space and a more expansive subway system -- ingredients for a modern metropolis.

However, the construction boom has been accompanied by fears that once the games end on Aug. 24, Beijing could plunge into a property slump.

![[Property]](http://s.wsj.net/public/resources/images/PR-AB116_CPROP_20080708221628.gif)

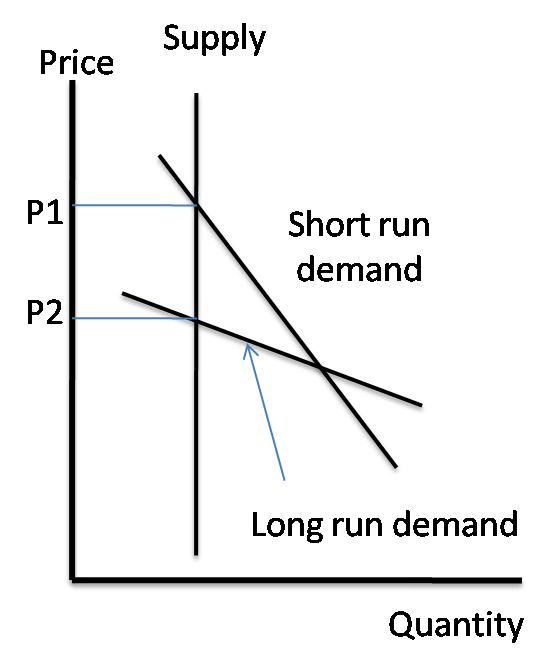

That isn't likely to happen. Property agents say the market may see higher vacancy rates and lower rents and sale prices in the months immediately after the Olympics, but they expect spaces to be filled eventually because Beijing remains a key city for doing business in China.

Property prices in Beijing, like those in the rest of China, have been falling from their spectacular highs, and they may correct further. The main reason for the cooling is the government's tightening over the past two years.

Speculation that housing prices are on their way down is helping to depress prices, says Ben Christensen, head of research in Beijing at property agent Jones Lang LaSalle.

"In Beijing that's sort of compounded by uncorrelated speculation that after the Olympics, prices are going to plummet," he says. "I don't see that. Nobody in the property industry sees that happening because there is no reason for it."

Much of what is going on in the Chinese capital is telling of a broader national trend -- rising incomes, urban sprawl and the growing sophistication of Chinese consumers underpinning demand for one of the world's hottest real-estate markets.

Migration of people from rural areas into cities looking for better jobs, bigger homes and higher living standards is driving urbanization across China. Foreign companies in China and domestic companies going global want high-grade buildings for their China headquarters.

But the big problem for China in recent years has been that prices rose too quickly to be sustained. "The government wants property prices to decline," says Lehman Brothers economist Mingchun Sun. "But they don't want to see a collapse of the property market because it is still one of the growth engines for the economy."

While Beijing's property market is tracking the national trend of a gradual cooling, policy makers are finding their biggest headaches in places like the southern boomtown of Shenzhen, just across the border from Hong Kong. A steep rise in prices in markets such as Shenzhen helped prompt the government to aggressively curb credit, land sales and mortgages nationwide during the past two years.

The growth in Beijing's property prices peaked in October 2007 at 15.1% and has been steadily slowing to 12.4% in May, based on data of China's 70 large and midsize cities from the National Development and Reform Commission. Shenzhen's swings have been sharper, with the rise in property prices dropping from nearly 21% in August 2007 to 2.5% in May.

Once property prices return to more affordable levels, demand from home buyers should kick in again, supported by individual income growth, which is rising 15% to 20% each year in China, Mr. Sun says.

If Beijing policy makers switch their focus from fighting inflation to shoring up weaker economic growth, the ensuing monetary easing would likely boost property prices again.

The average sales price now in Beijing's high-end residential market is estimated at 24,010 yuan ($3,500) per square meter, compared with 15,838 yuan at the end of 2006, according to Jones Lang LaSalle.

Mr. Christensen says prices in the high-end residential market should start to stabilize by year's end as investors evaluate their property investments more thoroughly. The bottom for prices in this market segment could be around 20,000 yuan per square meter, he says.

Jones Lang LaSalle says the new supply in Beijing's high-end residential and retail markets will roughly triple -- or more -- this year from last year. New luxury residential space will grow 30.4% this year to include 10,301 more units, compared to 11% growth in 2007. New supply in the retail market will rise 64%, or 1.4 million square meters this year, compared to 16% last year.

![[Chart]](http://s.wsj.net/public/resources/images/MI-AR602A_CMDLE_20080729204016.gif)

![[Before its collapse last year, the Interstate 35W bridge in Minneapolis was part of the one quarter of the nation's bridges that are considered either 'functionally obsolete' or 'structurally deficient.']](http://s.wsj.net/public/resources/images/P1-AM386_ROADWO_20080727195614.jpg)

![[Property]](http://s.wsj.net/public/resources/images/PR-AB116_CPROP_20080708221628.gif)