Sunday, December 27, 2009

South East Trip

I will keep posting lightly on the road, most likely some summary piece about year 2009.

Happy New Year!

Saturday, December 26, 2009

Ireland and Greece

WSJ compares the two weakest links in the European economy:

Greece and Ireland face the biggest fiscal problems in Europe. But their responses couldn't be more different. Greece's lack of credibility has cost it dearly in the eyes of ratings companies, the European Commission and the bond market. That means it will have to go even further than Ireland if it is to win back confidence.

Both countries face double-digit deficits this year: 12.7% of gross domestic product in Greece and around 12% in Ireland. Greece's debt-to-GDP ratio is forecast to hit 120% next year; Ireland's headline ratio of 64% would also rise to more than 100% if the bad debt taken on by the government under its bank bailouts is included. The European Commission is demanding both cut their deficits to below 3% of GDP and reduce debt-to-GDP to less than 60%.

Yet both the commission and the rating companies are taking a notably more lenient attitude toward Ireland than Greece. Ireland proposes only to cut its deficit to 10.8% of GDP in 2010, compared to 9.1% in Greece. But Ireland has been given until 2014 to meet the commission's demands, while Greece must achieve its targets by 2013. And Ireland is still rated AA, while Greece has just been downgraded to BBB+, raising fears its bonds may not qualify as European Central Bank collateral in the future. That would push up Greek borrowing costs, making it even harder to restore its fiscal position.

Ireland has won this breathing space partly because it has shown far greater political courage. Its 2010 budget includes clear tangible spending cuts. Public-sector wages are to fall by between 5% and 15%, with the prime minister taking a 20% pay cut. Even child-benefit payments are under the ax. In contrast, Greece's budget relies heavily on one-time policies such as measures aimed at reducing tax evasion. Athens has shown a lack of will to embrace spending cuts beyond a partial freeze in public-sector wages and pensions.

But Ireland's past record earns it a degree of forbearance. Between 1994 and 2006, Dublin cut debt to 24% of GDP from 94%, according to Barclays Capital. Compare that to Greece, which has very little credibility when it comes to making tough political decisions: it cut debt only to 94% of GDP in 1999 from 108% in 1994 ahead of euro entry, before it started rising again. Even now, Dublin enjoys broad public acceptance of its austerity plans. But Greece faced riots last year and renewed clashes this past week.

Still, Athens has little choice but to bite the bullet. The credit default swap market is pricing in an appreciable chance of a Greek default. Most likely, the European Union would provide a rescue package, but this would come with strict fiscal conditions attached. The Irish lesson may be a hard one, but Greece needs to learn it fast.

The state of economic recovery

Thursday, December 24, 2009

Senate Passes Landmark Health Bill

Monday, December 14, 2009

Paul Samuelson dies at 94

His death was announced by the Massachusetts Institute of Technology, which Mr. Samuelson helped build into one of the world's great centers of graduate education in economics.

In receiving the Nobel Prize in 1970, Mr. Samuelson was credited with transforming his discipline from one that ruminates about economic issues to one that solves problems, answering questions about cause and effect with mathematical rigor and clarity.

When economists "sit down with a piece of paper to calculate or analyze something, you would have to say that no one was more important in providing the tools they use and the ideas that they employ than Paul Samuelson," said Robert M. Solow, a fellow Nobel laureate and colleague of Mr. Samuelson's at M.I.T.

...

Mr. Samuelson wrote one of the most widely used college textbooks in the history of American education. The book, "Economics," first published in 1948, was the nation's best-selling textbook for nearly 30 years. Translated into 20 languages, it was selling 50,000 copies a year a half century after it first appeared.

...

A historian could well tell the story of 20th-century public debate over economic policy in America through the jousting between Mr. Samuelson and Milton Friedman, who won the Nobel in 1976. Mr. Samuelson said the two had almost always disagreed with each other but had remained friends. They met in 1933 at the University of Chicago, when Mr. Samuelson was an undergraduate and Mr. Friedman a graduate student.

Unlike the liberal Mr. Samuelson, the conservative Mr. Friedman opposed active government participation in most areas of the economy except national defense and law enforcement. He thought private enterprise and competition could do better and that government controls posed risks to individual freedoms.

Both men were fluid speakers as well as writers, and they debated often in public forums, in testimony before Congressional committees, in op-ed articles and in columns each of them wrote for Newsweek magazine. But Mr. Samuelson said he always had fear in his heart when he prepared for combat with Mr. Friedman, a formidably engaging debater.

"If you looked at a transcript afterward, it might seem clear that you had won the debate on points," he said. "But somehow, with members of the audience, you always seemed to come off as elite, and Milton seemed to have won the day."

Mr. Samuelson said he had never regarded Keynesianism as a religion, and he criticized some of his liberal colleagues for seeming to do so, earning himself, late in life, the label "l'enfant terrible emeritus." The experience of nations in the second half of the century, he said, had diminished his optimism about the ability of government to perform miracles.

If government gets too big, and too great a portion of the nation's income passes through it, he said, government becomes inefficient and unresponsive to the human needs "we do-gooders extol," and thus risks infringing on freedoms.

But, he said, no serious political or economic thinker would reject the fundamental Keynesian idea that a benevolent democratic government must do what it can to avert economic trouble in areas the free markets cannot. Neither government alone nor the markets alone, he said, could serve the public welfare without help from the other.

As nations became locked in global competition, and as the computerization of the workplace created daunting employment problems, he agreed with the economic conservatives in advocating that American corporations must stay lean and efficient and follow the general dictates of the free market.

But he warned that the harshness of the marketplace had to be tempered and that corporate downsizing and the reduction of government programs "must be done with a heart."

Despite his celebrated accomplishments, Mr. Samuelson preached and practiced humility. The M.I.T. economics department became famous for collegiality, in no small part because no one else could play prima donna if Mr. Samuelson refused the role, and, of course, he did. Economists, he told his students, as Churchill said of political colleagues, "have much to be humble about."

Sunday, December 13, 2009

Something about Joe Stiglitz

...

...

In 1993, Stiglitz abandoned his comfortable perch in academia for the rough-and-tumble of the policy world. He became a member of Clinton's CEA and later its chairman. Alan Blinder, a Princeton professor and a fellow CEA member, describes it as "a gutsy move for a purely academic superstar." Stiglitz was instrumental in pushing through several initiatives, including persuading a somewhat reluctant U.S. Treasury to issue inflation-indexed government debt. But Chait wrote in The American Prospect that Stiglitz's style of argument—making his case publicly even after losing internal debates on issues—led to wintry relationships with other presidential advisors, such as Larry Summers. Blinder says politely that "Joe's behavior . . . might perhaps be considered a little quixotic."

This style grew even more pronounced after Stiglitz moved in 1997 from the White House to become World Bank chief economist. He was critical of the economic advice to the transition economies to carry out a speedy move to markets and capitalism. Stiglitz favored a much more gradual move, with legal and institutional reforms needed to support a market economy preceding the transition to markets. Kenneth Rogoff, a Harvard professor and former chief economist of the IMF, doubts that Stiglitz's approach would have succeeded. He says it is "unlikely that market institutions could have been developed in a laboratory setting and without actually starting the messy transition to the market." Rogoff adds that because the institutions underpinning communism had collapsed, "some new institutions had to be created quickly," and it is inevitable that mistakes were made in this haste. But "institutions take a long time to nurture and the ones that are there today, however imperfect, might well not be there if the effort had not been started" immediately when communism fell.

During the financial crisis of 1997–98, Stiglitz publicly criticized the programs put together by the IMF and the governments of some Asian countries. Stiglitz argued that raising interest rates to defend the currencies in these countries was counterproductive: the high interest rates reduced confidence in the economy by increasing loan defaults and corporate bankruptcies. Not everyone agreed with Stiglitz. The late MIT economist Rudiger Dornbusch defended the high-interest-rate strategy as essential to restoring confidence, adding that "no finance minister will opt for the Stiglitz Clinic of Alternative Medicine. They [will] have the ambulance rush them to the IMF." J. Bradford DeLong, a noted macroeconomist at the University of California, Berkeley, wrote that following "Stiglitz's prescriptions [to] lend more with fewer conditions and have the government print more money to keep interest rates low . . . would have been overwhelmingly likely . . . to end in hyperinflation or in a much larger-scale financial crisis as the falling value of the currency eliminated every firm's and bank's ability to repay its hard [foreign] currency debt."

After exiting the World Bank in 1999, Stiglitz repaired to Columbia University and wrote what became a best-selling book titled Globalization and Its Discontents. Many reviewers of the book noted that its narrative power came from having a clear villain: the IMF. The book's references to the IMF—almost all critical—totaled 340. Tom Dawson, the IMF's external relations head at the time, quipped: "That works out to over one alleged mistake committed by the IMF per page. You'd think by sheer accident we'd have gotten a couple of things right."

...

Despite the financial crisis, Stiglitz remains optimistic about the future of markets and capitalism. In contrast to "the 19th century owner-operated capitalism, in the 21st century capitalism will be operated by the people," he says. But to make it a success, people have to be more economically literate and there has to be greater civic participation in economic policymaking. With these goals in mind, Stiglitz founded the Initiative for Policy Dialogue (IPD) in 2000—a global network of economists, political scientists, and policymakers that studies complex economic issues and provides policy alternatives to countries. IPD also conducts workshops to enable the media and civil society to participate effectively in policy circles. Dawson applauded the effort: "It's a tough business—you almost have to be a Bono to have an impact on policy."

Indeed, to reach wider audiences, Stiglitz has branched out into film with a documentary called Around the World with Joseph Stiglitz about how the fruits of capitalism can be shared more equally. Will it give filmmaker Michael Moore a run for his money? "No," laughs Stiglitz, "I think Moore is very effective," but "frustration doesn't do any good."

Unlike Moore, Stiglitz says he hasn't lost his "Midwestern optimism" that things improve over the long run. Many people, he says, express their dismay to him that, with the financial crisis barely over, the bankers and their boosters seem to be back calling the shots. But if genuine reform of the financial system is not undertaken, "there is a reasonable risk of another crisis within 10–15 years, and the likelihood that the banks will win the next round is lower." Every crisis provides "an impetus for deeper democratic reform. The game isn't over."

Taking stock

Best performing stocks, watch Ford, Capital One, AIG, and Bank of America.

(graph courtesy of bespoke)

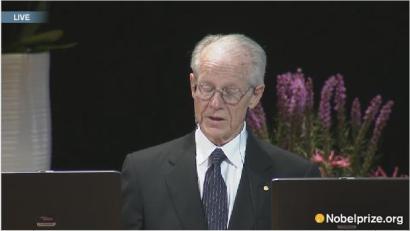

Oliver Williamson Nobel Speech

Retail sales

Friday, December 11, 2009

What to expect at Copenhagen

Thursday, December 10, 2009

On China's exchange rate policy

Jim O'Neill, Chief Economist at Goldman Sachs, counters that after almost 17% appreciation during the past few years, he is not sure Chinese Yuan is still undervalued. He is asking people to look at the evidence on the ground that China is actively restructuring its economy and China's domestic consumption is fast rising.

Dani Rodrik of Harvard University argues while most people focus on China's exchange rate, nobody is offering China a way out of its currency dilemma, and China is in no position to revalue its currency as demanded, as a large Yuan appreciation, say 25%, will kill China's economic growth by 2%.

The bottom line is China can't rely on export as its sole growth engine in the future; and the rest of the world should not blame all problems to China's currency policy.

Jim Rogers on dollar and gold

He is a true contrarian investor.

Wednesday, December 09, 2009

Warren: The coming collapse of American middle class

Personally, I think the prediction is over-exaggerated. But it's a refreshing speech.

Firms with job openings

House flipping, again?

The minimum bid, as set by a unit of Citigroup Inc., which had a $1.3 million mortgage on the home, was $379,900. After several minutes of bidding among investors and their representatives, some wearing shorts and flip-flops, Mr. Mirmelli won the home for $486,300. A week later, he agreed to sell it for $690,000 to a woman who moved in this month.

...

Flippers swoop in at public auctions of foreclosed homes, known as trustee or sheriff sales. In many states, the lender sets the minimum bid, and takes possession of the property only if no one bids more. In the past, the minimum generally was about equal to the mortgage balance due. But in today's market, in which many home values have dropped far below the loan balance, lenders wouldn't attract investors if they set the minimum at that level.

...

Sean O'Toole, chief executive officer of ForeclosureRadar.com, a research firm, estimates that in November about 21% of homes sold in trustee sales in California went to investors rather than to a foreclosing lender, up from 6% a year earlier. The trend is similar in some other areas with high foreclosure rates, including Phoenix and Miami.

...

The risk for banks is that if they set the minimum bid too low, the home might end up selling for much less than they could reap if they took ownership of it and sold it themselves. But with some 7.5 million U.S. households behind on their mortgage payments or in foreclosure, many lenders are overwhelmed. They're negotiating with distressed borrowers and figuring out how to sell the growing supply of foreclosed homes.

"The banks are so screwed up," says Mr. Mirmelli, the Phoenix investor, that they don't always have a clear idea of the value of the property they are foreclosing on.

Unemployment snapshot since recession began

December 2007 through October 2009

click to enlarge, Chart via Office of Thrift Supervision

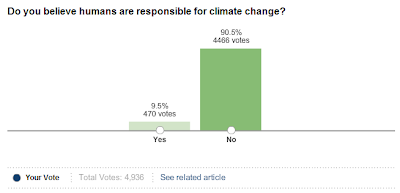

Poll on Climate Change

(click to enlarge; link to the poll)

Tuesday, December 08, 2009

Bernanke speech on economic recovery

Ten predictions of world economy 2010

Is gold in bubble yet?

Recession most likely ended in mid year

The improving labor market indicates the deepest U.S. recession since the 1930s may have ended, though it is too soon to say precisely what month it stopped, said the head of the group charged with making the call.

Payrolls fell by 11,000 workers in November, less than the most optimistic forecast among economists surveyed by Bloomberg, figures from the Labor Department showed today in Washington. The jobless rate declined to 10 percent.

"Today's report makes it seem that the trough in employment will be around this month," Robert Hall, who heads the National Bureau of Economic Research's Business Cycle Dating Committee, said in an interview. "The trough in output was probably some time in the summer. The committee will need to balance the midyear date for output against the end-of-year date for employment."

Among the top indicators the group uses is payrolls, according to its Web site. In the third quarter, the economy expanded at a 2.8 percent annual pace after a yearlong contraction.

Choosing between the dates "will take some time," Hall said. "We act deliberately."

Harvard University professor Jeffrey Frankel, another member of the committee, said the most likely date for the recession's end would be midyear.

"Mid-summer remains the best candidate for ultimate dating of the trough, probably July, or possibly June," he said.

The recession began in December 2007, the group said in December 2008. It usually takes six to 18 months to confirm a contraction's start or finish, according to the panel.

2001 Recession

Declaring the 2001 downturn over was complicated by continuing job losses. The group took until July 2003 to say that the slump had ended, 20 months after the fact.

Hall said he couldn't rule out a further decline in the economy that would make it harder to date the end of the recession.

The estimates for the low points in unemployment and output "presume that there won't be any new adverse shock," Hall said. "There are some horror-story scenarios that could stand in the way, so I don't see the point of forecasting. We just wait until we are ready."

Frankel said a second leg down for the economy would pose other difficulties for the committee.

"In the hypothetical event that the economy were to tank again in early 2010, would we call that a new recession or part of the same recession?" he said. "Probably the latter. Until we can answer that question the other way, we won't call the trough. So it will be awhile longer."

Monday, December 07, 2009

Hopenhagen

This hour On Point on America's public opinion toward climate change and global warming.

Consumer credit contraction in historical perspective

(click to enlarge, graph courtesy of calculatedrisk)

Sunday, December 06, 2009

Fierce battle on gold

One of the fiercest battles in the global financial system is being played out in the gold market. Does Friday's sharp drop in the gold price say much about who will win this fight?

On one side are central banks and governments, which are printing money and running up large fiscal deficits. On the other are investors who think such actions could debase paper currencies, and are buying gold to protect against that outcome.

Looking at Friday's 4% slide, even gold bugs would agree that a correction was to be expected for an asset whose price is up 56% in the past 12 months.

But gold bears might look at the trigger for the rout, a better-than-expected U.S. jobs number, and conclude that the economy is recovering and governments can soon wind down policies that benefit gold.

Clearly, a spell of gold weakness is likely. Not only has the run-up been intense, central bankers recently have sounded slightly tougher on monetary policy.

But the beauty of gold is that it is almost alone in providing protection for scenarios in which government stimulus fails or backfires. If economic weakness returns, the government's default response likely will be cranking out more money and running up bigger deficits. Alternatively, economies may take off too quickly, and high inflation returns. Both outcomes are extremely gold-friendly.

The gold trade gets really interesting if gross domestic product expands, but only sluggishly. If governments are willing to tolerate that, allowing the economy to adjust on its own, gold could suffer. After all, the best way to swat the gold bugs is to let the markets have their way.

Douglass North on 2009 Nobelists

Saturday, December 05, 2009

Is "bubble after bubble" the only way out?

Bernanke put

Not the best decade for stock returns

China's biggest threats

(click to enlarge)

Which country is the most desired to receive their education, in Chinese eyes:

whole report is here.

Cost of home ownership

As measured by the percentage of income devoted to mortgage payment, we are at historical low. This is a great time to own a house.

Caution to house speculators: do not hope for a quick price recovery.

(click to enlarge)

Thursday, December 03, 2009

Andy Xie: China got a "hot money" problem

At certain point, these hot money will want to flow out once investors realize their profits or just because it becomes too risky to stay in China. When this happens, China's property market and stock market will face huge downside risk. And that's when the housing market bubble will burst.

Interview of Andie Xie, Part I

Part 2

Part 3

Wednesday, December 02, 2009

Gold passes $1,200

Gold's rise has support from fundamentals, but every time you see parabolic move, the bubble is forming. One of the key lessons for investors is "bubble has legs", it will eventually burst, but nobody knows when.

In 2008, we had "mother of all bubbles" ---oil price shot up to $147 per gallon. In 2009-10, we may well have another greater bubble, the gold bubble: $2,000, anyone?

Tuesday, December 01, 2009

Anecdotal story on Chinese young consumers

The netbook revolution

Fortune Magazine reports on Asus' netbook revolution.

Some facts about climate change

source: Jørgen Delman

Key variables | China | USA | Japan |

| Population (million) | 1,320 | 302 | 128 |

| Per capita GDP (US$) (PPP) | 5,345 | 45,790 | 33,525 |

| Energy use per unit of GDP (toe/ thousand US$) | 0.26 | 0.17 | 0.12 |

| Per capita CO2eq emissions (2003 data; tons) | 3.2 | 19.5 | 9.8 |

|

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c246d157-306c-49b3-ac7b-dc83ccb6d093)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b69228cc-102f-4691-ac06-00b6a6bc7128)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=36d206e7-a04a-4080-8b36-8fc7e50bba9f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b31d3ec4-cae4-4753-82d0-3ff4fa548917)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=27efad63-455e-41ea-aa91-9c68ff31b9f4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=bf19845b-8127-43d5-ab53-fd722989050d)